- The Fixer

- Posts

- Trust lost needn’t be lost forever

Trust lost needn’t be lost forever

Welcome to The Fixer, a weekly newsletter from The WayFinders Group. We’re organisational repair specialists who repair damage, rebuild trust, and restore performance. On Fridays, we examine unfolding corporate crises — breakdowns that reveal what happens when damage goes unrepaired, and what you can do in the face of a fiasco.

Friday’s fiasco: departures that don’t fix the damage

Brad Karp stepped down as chair of Paul Weiss this week after US Department of Justice (DOJ) documents revealed his relationship with Jeffrey Epstein. The DoJ emails show Karp discussing legal strategy with Epstein in March 2019, describing arguments as "in great shape" and noting "I particularly liked the argument that the 'victims' lied in wait." He told Epstein "hope you're staying calm" and asked "what can I do to help." Epstein replied: "your judgment and friendship."

source: ft.com

These conversations happened four months before Epstein's arrest. Years after his 2008 conviction. Whilst Karp chaired a major law firm.

Paul Weiss partners moved fast. Scott Barshay takes over as chair. The firm emphasises neither Karp nor Paul Weiss ever represented Epstein directly; they worked for Leon Black on fee disputes. So with that legal proviso, Karp stays on as partner focusing on client work. The firm's statement called recent reporting "a distraction” and their action addresses the immediate reputational crisis, uncomfortable headlines, and difficult client conversations.

But the fiasco is about what enabled Karp to provide strategic counsel to a convicted child sex offender, outside any formal retainer, with apparently nobody questioning whether this was appropriate. Because what his departure doesn't address is how this was able to transpire in the first place.

Critical questions

The critical question isn't "did anyone know?" It's "should anyone have known?" When relationships are subject to DOJ scrutiny revealing extensive correspondence, they ought to have been visible enough for partners to notice. When nobody notices, you have an oversight problem. If people notice but say nothing, you have an accountability problem. If people raise concerns and nothing happens, you have a challenge problem.

When a firm moves this quickly to quell a storm, it is unlikely these questions have been asked. Paul Weiss' damage sits externally beyond professional oversight or formal billing structures, in unclear boundaries between personal and professional relationships with clients and former clients, insurance risk, accountability vacuums where partner conduct goes unchallenged, potential criminality for juniors and support staff, and an inability for anyone to raise concerns about senior leadership perceived as untouchable.

Scott Barshay faces a choice that every incoming leader faces after a crisis: fix the optics or fix the damage.

Elite professional firms consistently treat cultural damage as individual problems. When a partner does something problematic, the partner leaves and the firm moves on. But the chair hasn't left the firm. Which means the firm is leaning into the idea that Brad Karp really is untouchable. The conflict between existing billing relationships when the rainmaker holds the cards emphasises the accountability tussle that is going on here.

What would we advise Paul Weiss?

Quantify the damage internally before it costs you more than reputation externally. This is a controversial approach for a US law firm where money talks. But you can't restore client confidence when your own people don't trust that accountability applies to rainmakers. Fix the culture inside the firm first. Then you'll have something credible to say externally.

Our Organisational Repair Index™️(ORI) measures damage across nine factors to show precisely where cultural failures create risk. With diagnostic data, you know where to focus resources and can track whether repair work is addressing risk rather than managing headlines. Then we would advise the following:

Acknowledgement: Partners need to hear what actually happened and how it was possible. Not statements about "distractions," but examination of how the chair maintained advisory relationships with a convicted sex offender whilst nobody questioned it. What made this possible? Who knew? Who should have known? What stopped anyone from raising concerns?

Apology: The partnership owes its people acknowledgement that leadership failed them. That junior lawyers and support staff were potentially exposed to criminality risk. That the culture allowed this to continue unchallenged.

Accountability: Establish measurable accountability where oversight collapsed. Create challenge mechanisms that function for everyone, not just those without billing relationships. Make clear partnership status doesn't create untouchability, especially when Karp remains at the firm.

Amends: Rebuild feedback loops that should have surfaced concerns. Implement structural changes preventing informal advisory relationships operating outside oversight. Demonstrate the internal culture has changed before making external promises to clients.

The alternative is hoping swift leadership transition solves the problem whilst the chair remains as a billing partner. Which sends a clear message to everyone watching: some people really are untouchable. That's not repair. That's preservation of exactly the culture that created this fiasco. And when the next scandal surfaces, you'll be doing this again. Only this time, you won't be able to claim you didn't see it coming.

Leah Brown FRSA is the UK's leading specialist in organisational repair and founder of The WayFinders Group.

Fixer files: three questions for ExCo

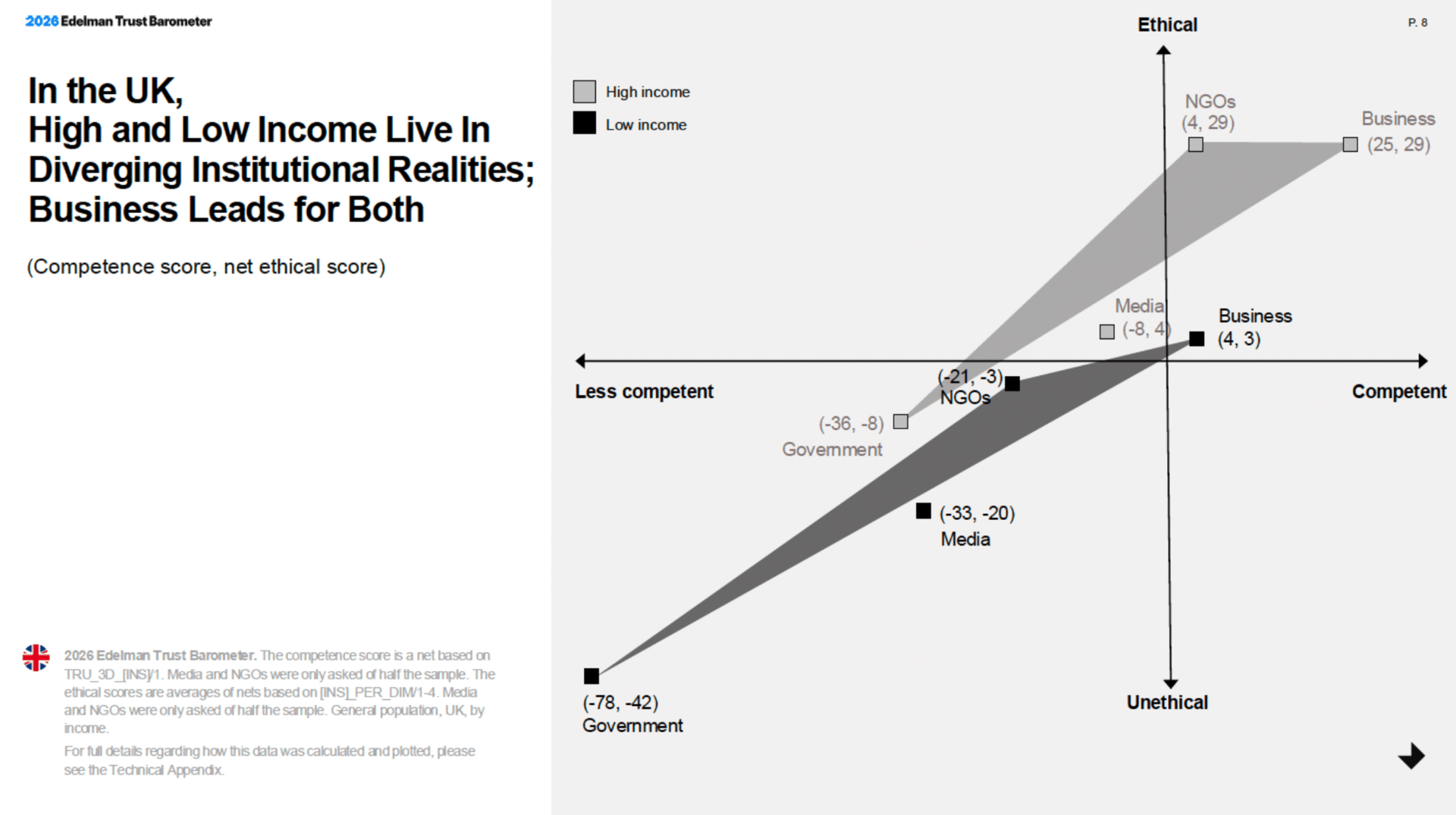

If the Paul Weiss fiasco illustrates what happens when accountability fails internally, the 2026 Edelman Trust Barometer shows why that failure costs you externally.

Did you know 76% of UK respondents are unwilling or hesitant to trust someone different from them, and the income-based trust divide has expanded to 19 points?

Note: sector-based chart showing how high and low income groups in the UK perceive institutions differently - Business appears competent and ethical to high earners but barely registers for low earners; Government sits in the unethical and incompetent quadrant for low earners while appearing more competent to high earners; Media is perceived as unethical by low earners; NGOs appear more ethical to high earners.

If you're a CEO, here are three questions to raise in ExCo on Monday:

1. Do we know our customer / client trust score by income level?

High earners trust at 57; low earners at 38. That 19-point gap affects customer behaviour, employee retention, and regulatory relationships. If your ExCo is tracking aggregated reputation scores without demographic segmentation, you're missing your biggest operational risk.

Ask your finance director: do we have data on trust among our employees, our customers, or in the communities where we operate?

If they can't answer, you're flying blind on a 19-point gap that's costing you revenue, talent, and licence to operate. When organisations broker trust well, low-income respondents' trust scores jump from 49 to 67. That's an 18-point lift with quantifiable business impact you're currently not tracking. Our corporate partners at TrustBuilder® can help you close that gap.

2. Do I need to meet with our critics?

65% of respondents said having CEOs constructively engage with groups who criticise or distrust the company would be effective for building trust. In practice this wouldn’t be a town hall with pre-vetted questions, it would require a private meeting with people who think you got it wrong and want to tell you why.

Ask yourself: when did I last sit in a room with people who distrust this organisation or have reservations about my leadership? If the answer is "never" or "not since the crisis," you’re affecting long-term profitability.

3. Who's actually in the room when we make decisions?

72% said ensuring CEOs consult people with different values and backgrounds when making decisions would be effective for trust building.

Ask your executive team: who was in the room for our last five major decisions and empowered to contribute? Were they invited to contribute at the board meeting? Are they the right people to be making decisions or do we need wider input?

Blind spots are not a fiction. If it’s obvious that you’re surrounded by people who share your outlook, income bracket and political persuasions, insularity may become your downfall. Diversity of thought may feel costly in the short term but almost always pays off long term.

Worth reading: The full 2026 Edelman Trust Barometer UK Report, particularly pages 26-33 on institutional trust brokering effectiveness and employer positioning.

Friday poll

If you were chair of Paul Weiss, what would you prioritise first? |

We love your feedback so please keep it coming. Have a great weekend!

The WayFinders Group: helping you repair damage, rebuild trust, and restore performance. Our 90-day repair programme is powered by the ORI™ . Contact us by clicking the button below. ⤵️